Ken Semler

Named in a Special Report by Hanley Wood as one of the five leading voices in the modular home construction industry.

Ken Semler provides strategic vision and leadership to builders and construction companies that utilize hybrid modular building techniques.

Based on his experience he is able to deliver unique insights through consulting, conferences and workshops. Learn more about Ken…

25+

Years in the Construction Industry

42

States Where Contractor/Builders

175+

Modular Articles Written

KEN'S SPECIALTIES

Consulting & Coaching

Guidance for builders, entrepreneurs, and real estate professionals through one-on-one coaching, partner training, and strategic advice on modular and hybrid modular construction.

Speaking & Workshops

Engaging keynote sessions and interactive workshops that inspire builders, architects, and developers to embrace the future of modular construction.

Franchising Opportunities

Join Impresa Modular, the first custom modular home franchise, and gain access to proven systems, training, and factory partnerships to grow your business.

Resources & Thought Leadership

Stay ahead with insights, articles, and podcasts on modular construction, affordability, building technology, and industry best practices.

Ken's Articles On Modular Construction

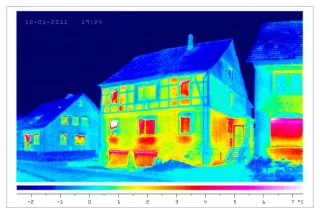

Building Science Makes Your New Home Better

Explore how building science principles like air sealing, thermal envelopes, moisture control, and indoor air quality improve home performance—and why modular construction delivers better results unde... ...more

Modular Home Construction

March 22, 2025•5 min read

What If Ben Franklin Invented Modular Construction?

Imagine modular construction centuries ago. Ken Semler explores early examples, innovation gaps, and how off-site building could’ve transformed homebuilding if Franklin had invented it. ...more

Industry Insights

March 15, 2023•6 min read

How Do You Appraise a Home and Why Do You Want One?

Learn how home appraisals determine property value using cost, sales, and income approaches. Understand why appraisals matter for buyers and sellers. ...more

Industry Insights

February 24, 2023•5 min read

Hear Ken Share Insights on Modular Construction

Podcasts, interviews, and webinars featuring Ken Semler — delivering expertise on modular housing, franchising, and the future of construction.

Ken in the Spotlight

Shape the Future of Housing with Ken’s Guidance.

© 2025 by Ken Semler of ImpresaModular.com - All Rights Reserved.