Today’s Interest Rate – Why You Should Care

Interest rates are now getting back down to historical lows. What do low rates mean for homebuyers? It means that you can get much more home for the same payment! An interest rate difference reduction of just a few tenths of a percent can provide you with “free” coffee every day and a weekly dinner out for you. A difference of one percent or more could be a “free” car payment, depending on the size of your loan! Let’s review the economics of home loan rates. You may not want to put off building that new home for much longer!

What are the Main Factors that Influence Your Home Purchasing Power?

There are four fundamental factors that play a significant role in determining how large a mortgage you will qualify to get (a.k.a. your home buying power.) These are your monthly income, your credit score, your monthly debt ratios, and your down payment. If anyone of these is lacking, or lacking significantly, your dream of owning or building a home can be significantly impacted. By starting today, you can make improvements in each area that can insure you can build the home you want when the time comes!

Your home loan’s size is just the beginning

When shopping for a mortgage your interest rate has a huge impact on the amount of mortgage you can obtain. That’s because mortgage rates affect more than just the interest you’ll pay over the life of your loan. Your fixed rate also plays a major role in determining your “home buying power” — meaning how much home you can afford. Mortgage rates have been near record lows over the past few months. That means many prospective homebuyers can likely afford a more expensive home than they previously thought.

Are you wondering what you could afford with today’s low interest? Websites like Credit Karma have started to offer Home Buying Power Calculators. They collect all of the information that impacts your home buying power and then provide you with the tools to perform “what if” situations. See what happens when your credit score goes up or down, etc.

How Current Mortgage Rates Impact Buying Power

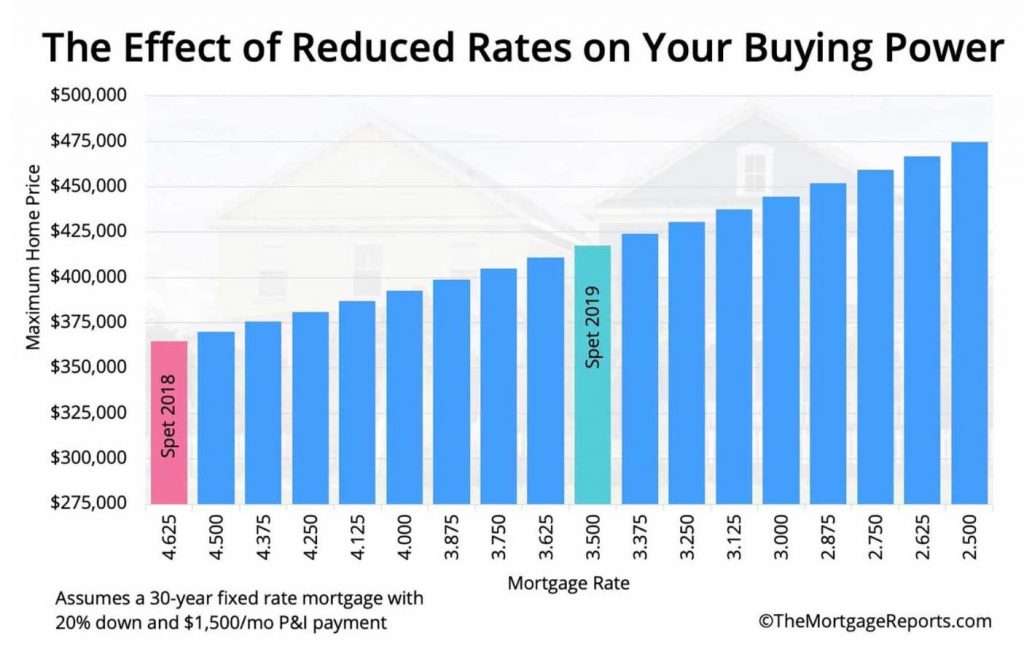

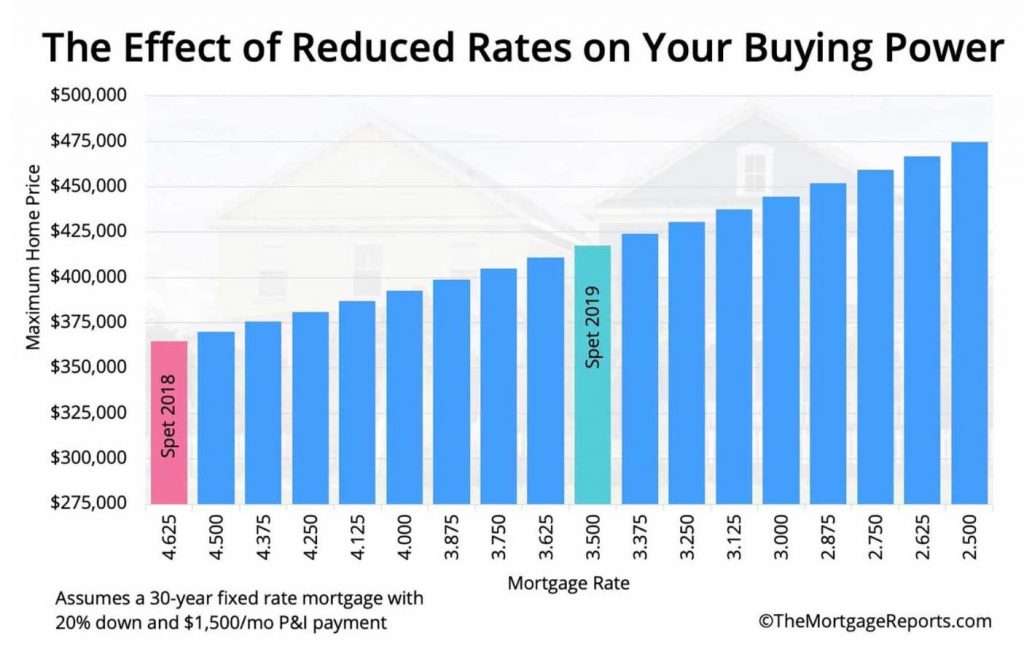

Mortgage rates fell in August and September this year, getting close to record lows. September’s low reached 3.5% for a 30-year, fixed-rate mortgage. At that rate, it would be possible to afford a home valued at more than $400,000 and pay only about $1,500 per month (not including taxes, insurance, or HOA fees).

A year ago, when rates were over 4.6%, the same monthly payment might have gotten you a home priced less than $375,000. In fact, with each 0.125% change in mortgage rates, your buying power can increase or decrease. With each 0.125% change in mortgage rates, your home buying power can rise or fall. Rates have dropped significantly since last year.

If you’ve been on the fence about purchasing a home, you probably want to act soon. You may find that you can afford a bigger home with more features and amenities than you thought. All of this at a lower payment than you probably imagined.

A 1% rate drop could add $30,000 to your budget!

It’s no secret that lower mortgage rates usually equate to a lower monthly payment. With a 1% point drop in rates, for example from 4.5% to 3.5%, you could get a monthly savings of $167 on a $200,000 mortgage.

To illustrate this further take a look at the following example:

A home buyer has a monthly gross income of $5,000 and an expected total monthly debt of $2,250. His debt-to-income ratio is 45%.

Steve takes out a 30-year fixed loan of $250,000. At 4% interest, his monthly payment for principal, interest, taxes, and insurance (PITI) would be $1,193.

But say his rate was actually 3.5%.

That rate decrease of a half percent increases his purchasing power by $15,000; that assumes $1,122 is the maximum payment he can afford.

If the rate was 3%, it would lower his monthly payment to the amazingly low amount of $1,051.

That would boost his buying power by $30,000.

| Interest rate | 4% | 3.5% | 3% |

| Monthly payment* | $1,193 | $1,122 | $1,051 |

| Homebuying power | +$15,000 | +$30,000 |

*Monthly payments shown include principal, interest, taxes, and insurance (PITI)

An Interest Rate Lesson

Mortgage rates directly affect a buyer’s required monthly payment. Early on in a typical 30-year mortgage, more than 95% of a buyer’s monthly payment goes toward interest. The lower the mortgage rate, the lower the amount of interest that needs to be paid. And the lower the monthly payment, the more affordable the home is on a month-to-month basis.

The lower the mortgage rate, the lower the interest. The lower the interest, the more affordable the home is on a month-to-month basis. What this means is that if you can afford a certain monthly payment based on your income, you can afford to take out a larger mortgage if interest rates are lower.

Will mortgage rates drop again soon?

Should you wait for rates to drop even lower, which would increase your purchasing power? Or should you lock in now and purchase sooner? Current mortgage rates are around 3.5%. That’s very close to a generational low and very favorable. In the past when home buyers wait out the lowest rate they tend to miss the bottom and catch the higher rate on the other site. When building a home, it takes time in planning and loan approvals. Waiting could lead to missing the lowest rates of a generation.

Should you wait for rates to drop even lower, which would increase your purchasing power? Or should you lock in now and purchase sooner? Current mortgage rates are around 3.5%. That’s very close to a generational low and very favorable. In the past when home buyers wait out the lowest rate they tend to miss the bottom and catch the higher rate on the other site. When building a home, it takes time in planning and loan approvals. Waiting could lead to missing the lowest rates of a generation.

Get More with Modular

When you decide it is time to build your new home and you know you will need to finance it, don’t wait. The very first place you should go is to a construction loan lender and get qualified for a loan. It is important to know if you qualify, and how much you qualify for when you start the actual search for your new home plan.

A home built using modular construction is treated just like a home built on site for conventional 30 year or 15 year mortgages. However, there are some slight differences when it comes to how the construction loan works for modular homes. Modular construction takes the big bang approach. On site, a modular home shows up about 75-80% complete because it was built offsite. Because more is completed off site, factory efficiencies mean modular homes a built at a better value, with better quality, and with the ability to build using almost any design style. Modular means more!

The post Today’s Interest Rate – Why You Should Care appeared first on Impresa Modular.